Donate to St. Mary’s Food Bank through a gift of stock or from your Individual Retirement Account (IRA) and help us continue our mission of Bridging the gap for Arizona communities with nourishment for today and hope for tomorrow.

IRA Required Minimum Distribution (RMD)

If you are 70 ½ years or older, you can donate up to $105,000 directly from your IRA to your charities of choice. By doing this, you may avoid a higher income tax bracket and prevent phasing out of other tax deductions. There are some other limitations. Please consult your tax professional.

A Qualified Charitable Distribution (QCD) to St. Mary’s from your IRA will satisfy your Required Minimum Distribution (RMD).

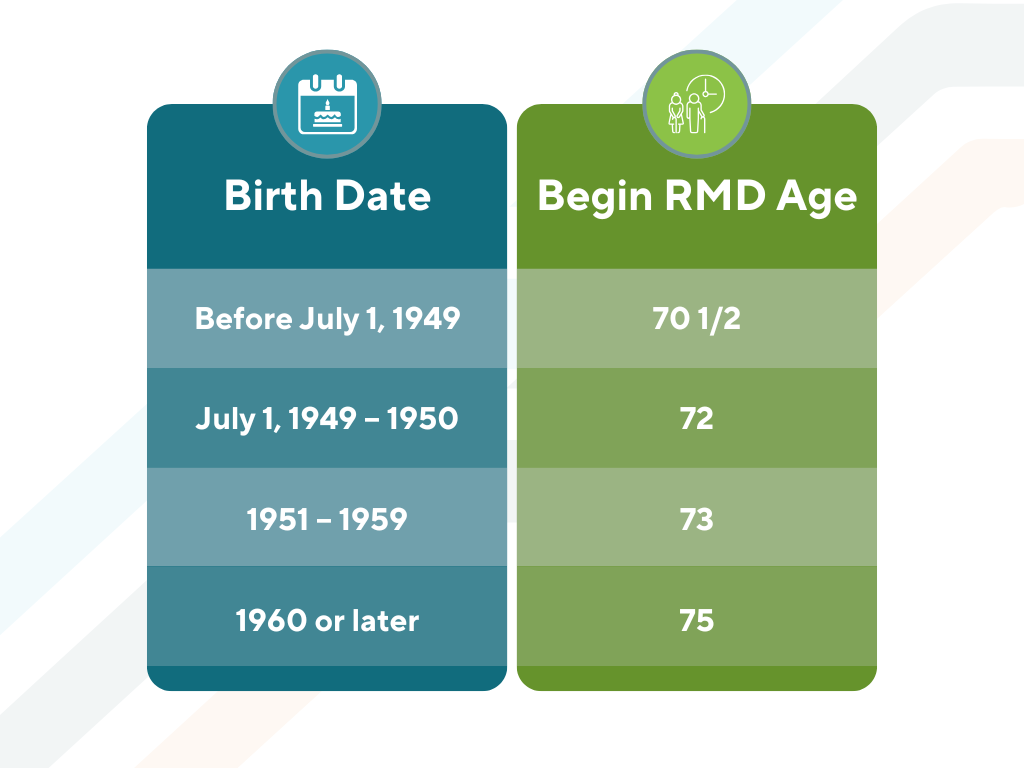

Required Minimum Distributions (RMD) begin when you reach a certain age based on your birth year:

IRA Required Minimum Distribution (RMD)

If you are 70 ½ years or older, you can donate up to $105,000 directly from your IRA to your charities of choice. By doing this, you may avoid a higher income tax bracket and prevent phasing out of other tax deductions. There are some other limitations. Please consult your tax professional.

A Qualified Charitable Distribution (QCD) to St. Mary’s from your IRA will satisfy your Required Minimum Distribution (RMD).

Required Minimum Distributions (RMD) begin when you reach a certain age based on your birth year:

Contact your financial institution to send your donation via check or wire to St. Mary’s Food Bank.

Necessary information to send funds to

St. Mary’s Food Bank

Tax ID:

23-7353532

Physical Address:

2831 N 31st Ave,

Phoenix, AZ 85009

Wiring Instructions

St. Mary’s Food Bank Alliance

Financial Institution:

Wells Fargo Bank Arizona, N.A.

100 W Washington Street

Phoenix, AZ 85003

Account Number: 1175969193

Account Type: Business Checking

Routing Number:

Wire: 121000248

ACH: 122105278

Contact your financial institution to send your donation via check or wire to St. Mary’s Food Bank.

Necessary information to send funds to St. Mary’s Food Bank

Tax id: 23-7353532

Physical address: 2831 N 31st Ave, Phoenix, AZ 85009

Wiring Instructions

St. Mary’s Food Bank Alliance

Financial Institution:

Wells Fargo Bank Arizona, N.A.

100 W Washington Street

Phoenix, AZ 85003

Account Number: 1175969193

Account Type: Business Checking

Routing Number:

Wire: 121000248

ACH: 122105278

How to Donate Stock

Contact your broker or financial advisor to initiate the transfer, and upon confirmation, St. Mary’s will send an acknowledgment of receipt of your gift.

St. Mary's Food Bank has set up a brokerage account where we accept Depository Trust Company (DTC) transfers of securities:

Merrill Lynch

DTC #8862

Account # 412-04B37

Contact: James Marten

2555 E. Camelback Road, Ste 1000 Phoenix, AZ 85016

TEL: 602-954-5016

Email: [email protected]

Complete and submit this form to help ensure proper recordkeeping.

Worthy of Your Trust

95% of all donations to St. Mary’s Food Bank go directly to help feeding hungry children and families right here in our community.